What is Form 433-D?

If you owe a significant amount of money to the IRS and are unable to pay the full amount at once, setting up an installment agreement form 433-D can help you manage your debt. One way to set up an installment agreement is by filling out Form 433-D, which is used to request a monthly payment plan. This form is used to determine your ability to pay the IRS and set up a direct debit installment agreement.

When a Direct Debit Installment Agreement is required:

- For individuals, sole proprietors or independent contractors:

- If your total tax balance is over $25,000, you must pay by direct debit

- For businesses:

- If your total tax balance is over $10,000, you must pay by direct debit

Applying for an Installment Agreement

First, you need to apply for an IRS payment plan through Form 9465. What is the difference between Form 9465 and Form 433-D? You use Form 9465 to request a payment plan with the IRS. Once the IRS approves your payment plan, you then use Form 433-D to set up direct debit installment payments.

The key difference is that the 433-D form allows you to authorize the IRS to automatically withdraw payments directly from your bank account as part of the installment agreement.

Installment Agreement User Fees

User fees are charges that the IRS is required to collect by the Office of Management and Budget when setting up payment plans and other services. The purpose of these fees is to recover the administrative costs for the IRS to manage these payment arrangements.

The specific user fees for IRS installment agreements vary depending on how you apply for the payment plan and how you end up paying:

- If you apply for the installment agreement online:

- $31 fee if you pay by direct debit from a bank account

- $130 fee if you pay by check, money order, credit card or debit card

- If you apply any other way (phone, mail, in-person):

- $107 fee to set up a direct debit payment plan

- $225 fee for other payment methods (check, money order, credit/debit card)

The higher fees for non-direct debit payments reflect the additional processing costs for the IRS.

Low-Income Taxpayer Reductions

If you qualify as a low-income taxpayer, you may be eligible to have these user fees reduced or waived. To request this, you can fill out and submit IRS Form 13844 to the following address:

Internal Revenue Service

PO Box 219236, Stop 5050

Kansas City, MO 64121-9236

The user fees can generally be included as part of your overall monthly installment payment plan, rather than requiring a separate upfront payment.

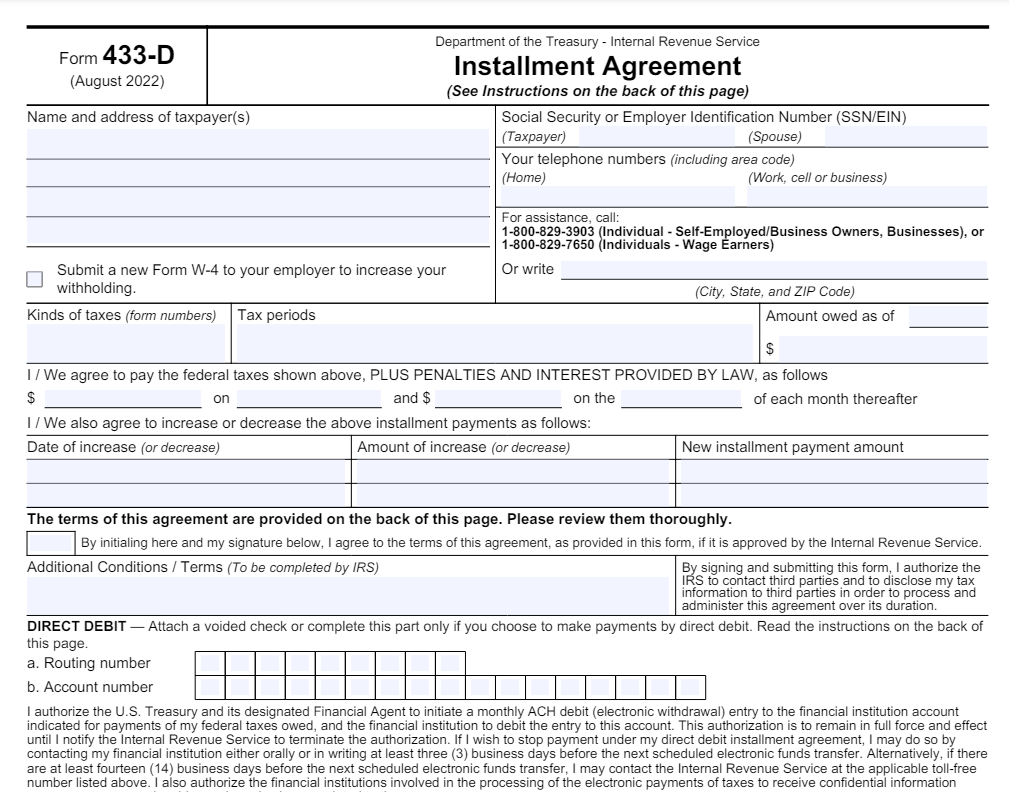

What Information Does 433-D Require?

This one-page form requires information such as:

- Your Social Security Number or Employer Identification Number

- Contact details

- Specifics about your existing payment plan

- Bank routing and account numbers to facilitate the automatic withdrawals

It’s important to double-check that the routing number is valid (starting with 01-12 or 21-32) and to input your account number accurately, without any spaces or special characters.

Monitoring Your Payments

Once the Direct Debit Installment Agreement is in place, you can track your payment history and account balance through your online IRS account. Keep in mind that it may take up to three weeks for a recent payment to be reflected in your account.

If you find yourself struggling at any point, don’t hesitate to seek help. Book a consultation with us at www.qbtconsulting.com, We can provide expert advice and ensure your financial records are in order, giving you peace of mind. Also, make sure to stay up to date with latest tax and bookkeeping news on our blog.