What is IRS Form 843?

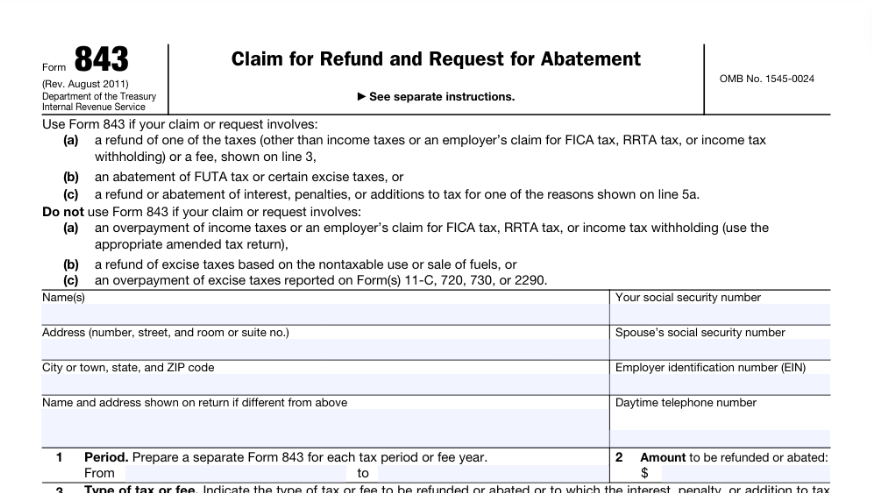

Form 843, also known as the “Claim for Refund and Request for Abatement,” is a formal document issued by the Internal Revenue Service (IRS) to allow taxpayers to seek refunds or seek reductions in penalties, interest, or outstanding tax obligations. You can access Form 843 on the official IRS website and obtain a printable version for submission. This form acts as an official plea for alleviation from specific tax liabilities or consequences imposed by the IRS.

Why Might You Need Form 843?

- Penalty Abatement: Taxpayers facing penalties for late filing, late payment, or inaccuracies in reporting may use Form 843 to request relief from these penalties, provided they have reasonable cause.

- Interest Abatement: In some cases, taxpayers may be eligible to request a reduction or elimination of interest charges imposed by the IRS, typically if the interest accrued due to IRS errors or delays.

- Overpayment of Taxes: If you believe you’ve overpaid your taxes or have been assessed penalties or interest incorrectly, you can use Form 843 to claim a refund or request an abatement.

How to Fill Out Form 843: Step-by-Step

Filling out Form 843 requires careful attention to detail to ensure accurate processing. Here’s a step-by-step guide:

- Provide Personal Information: Enter your name, address, Social Security number, and other identifying information at the top of the form.

- Choose the Reason for Filing: Check the appropriate box(es) to indicate the reason(s) for filing Form 843, whether it’s for a refund, penalty abatement, interest abatement, or another eligible reason.

- Explain Reason for Claim or Request: In Part II of the form, provide a detailed explanation of the circumstances that warrant your claim for refund or request for abatement. Clearly state the facts and reasons supporting your request, including any relevant documentation.

- Calculate the Amount: If you’re claiming a refund or requesting a reduction in penalties or interest, calculate the specific amount you’re seeking to abate.

- Signature and Date: Sign and date the form to certify that the information provided is accurate and complete.

Can I submit form 843 online?

Once you’ve completed Form 843, you’ll need to mail it to the appropriate address based on your location. Option for submitting form 843 online is not available. The mailing address is typically provided in the instructions accompanying the form. Ensure you send it to the correct address to avoid delays in processing.

If you need help or more info, book a consultation with us at www.qbtconsulting.com, and make sure to stay up to date with latest news on our blog.