When it comes to tax preparation, the W-2 and W-4 forms are arguably the most important pieces of the puzzle. Understanding these tax forms is essential for both employees and employers. Here is what these forms are, when to use them, and why they are important.

What is form w-2?

The W-2 form, also known as the Wage and Tax Statement, is a document that employers must provide to their employees at the end of each year. This form reports an employee’s annual wages and the amount of taxes withheld from their paycheck.

Independent contractors do not qualify for a W-2 form. Instead, you’ll need to complete a 1099-NEC form for them at the end of the year. However, 1099 forms are not limited to contractors: if you have paid anyone over $600 for services (or rent) throughout the year—such as your landlord or your lawyer—you also need to provide them with a 1099 form.

When it comes to the W-2 form, six copies are required because they serve different purposes for various entities involved in the tax filing process. The employer is responsible for generating and distributing the six copies of the W-2 form.

Employers must distribute these copies accordingly by January 31st of the following year. Here’s how it typically works:

Copy A: Sent to the Social Security Administration (SSA) to report wages and taxes.

Copy B: Given to the employee to be filed with their federal tax return.

Copy C: Given to the employee for their records

Copy D: Retained by the employer for their records.

Copy 1: Submitted to the state, city, or local tax department, if applicable.

Copy 2: Given to the employee to be filed with their state, city, or local tax return, if applicable.

What is form w-4?

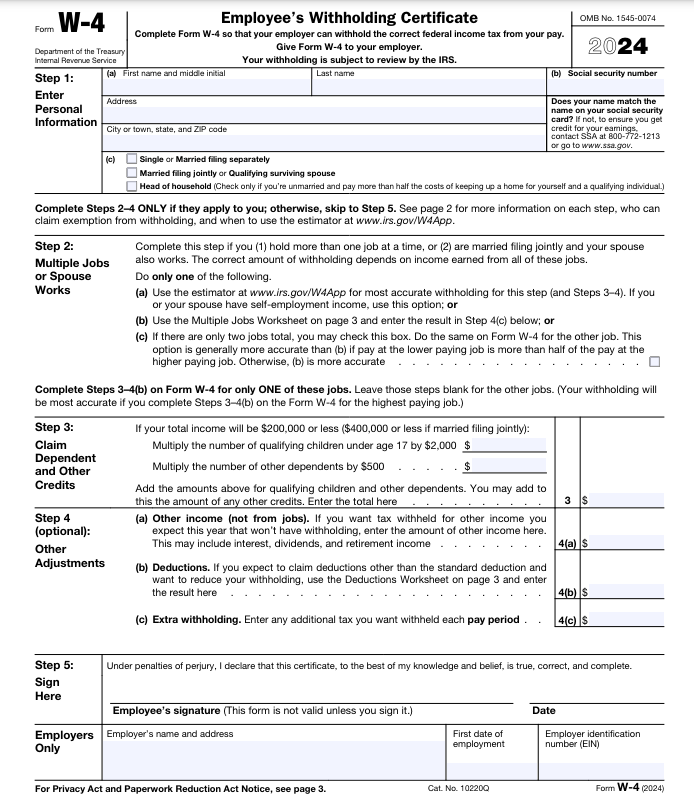

The W-4 form, also known as the Employee’s Withholding Certificate, is a payroll document that guides your employer on the amount of tax to withhold from your income. It is filled out by employees when they start a new job, and they should update it whenever they experience major life events that affect their tax situation, such as marriage, divorce, or the birth of a child.

Accurate completion of the W-4 ensures the correct amount of federal income tax is withheld, preventing large tax bills or refunds at the end of the year. If you reside in Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, or Wyoming, you are not required to pay state income tax.

Your tax liability is generally lower if you are married compared to being single, and it decreases further if you have dependents, such as children. You can claim withholding allowances to reduce the amount of tax withheld from your paycheck. For instance, you can claim one allowance for each qualifying child under 17 and for each additional dependent, like an elderly parent.

You should increase your withholding allowances if both you and your spouse are employed or if you have additional income not subject to withholding, such as pension income or substantial interest or dividends.

Conversely, you should decrease your withholding allowances if you make estimated tax payments, qualify for tax credits like the child tax credit, or qualify for deductions beyond the standard deduction, such as student loan interest or IRA contributions, or if you itemize deductions instead of taking the standard deduction.

Why Are These Forms Important?

For Employees:

- W-2: The W-2 is essential for filing accurate tax returns. It provides a summary of earnings and tax withholdings, helping employees determine whether they owe additional taxes or are entitled to a refund.

- W-4: The W-4 helps employees manage their tax liability throughout the year. By adjusting withholdings, employees can avoid owing a large amount of money at tax time or receiving a significant refund, which means they had too much tax withheld during the year.

For Employers:

- W-2: Employers are legally required to provide W-2 forms to their employees and the Social Security Administration (SSA). Accurate and timely filing is crucial to avoid penalties and ensure compliance with tax laws.

- W-4: Employers use the W-4 to determine how much federal income tax to withhold from each paycheck. Proper withholding based on the W-4 helps employers avoid issues with the IRS and ensures employees’ tax obligations are met.

If you find yourself struggling at any point, don’t hesitate to seek help. Book a consultation with us at www.qbtconsulting.com, We can provide expert advice and ensure your financial records are in order, giving you peace of mind. Also, make sure to stay up to date with latest tax and bookkeeping news on our blog.

The information provided here is for educational purposes only and does not constitute legal, financial, or tax advice. QBT Consulting strongly recommends consulting a qualified professional before taking any actions based on the contents of this post. QBT Consulting assumes no liability for actions taken in reliance on the information provided. Seek expert guidance tailored to your specific circumstances.